New Delhi (NVI): The Reserve Bank of India today announced a three-month moratorium on EMI payments of all term loans outstanding as of March 1, 2020, amid the 21-day lockdown due to the pandemic situation in the country.

This decision applies to all regional, rural banks, co-operative banks, NBFCs including Housing Finance Companies.

With the RBI giving a green signal to defer loan repayment for three months, the ball is in the banks’ court to pass on the benefit to people, many of whom have been affected due to job loss and salary cuts in wake of COVID-19 crisis.

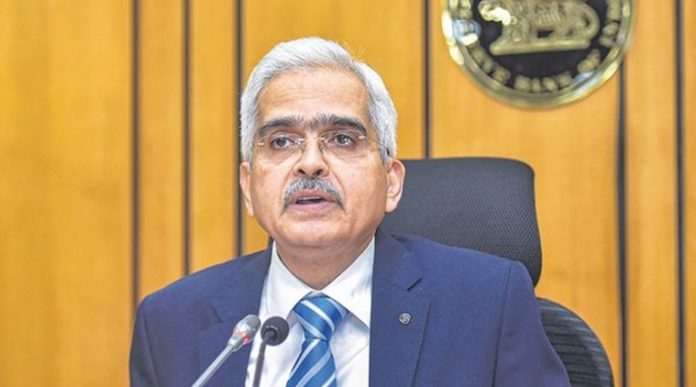

RBI governor Shaktikanta Das in a briefing today also announced that the repo rate has been reduced by 75 basis points (bps) to 4.4 per cent. The reserve repo rate has been reduced by 90 basis points to 4 per cent.

The Repo rate cut – which is the rate of interest at which banks borrow from RBI – will ensure banks have more access to funds, while the Reverse-repo rate cut will make it less attractive for banks to park their funds with the central bank.

This comes at a time when the country is under a 21-day lockdown to curb the coronavirus contagion, which might result in adverse effects on the economy due.

The decision comes a day after the government announced Rs 1.7 lakh crore worth relief package for poor people, employees and women to cope with the COVID-19 crisis.

The RBI Governor also said that the Indian banking system is “safe and sound” and depositors should not resort to panic withdrawal of their deposits. He urged those with deposits in private banks to not indulge in panic withdrawal. Measures were also announced and listed to shore up liquidity.