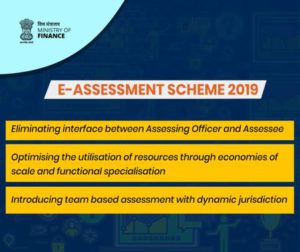

New Delhi: The much-touted and talked-about faceless assessment of taxpayers has become a reality with the launch of the National e-Assessment Scheme (NeAC) on October 7, 2019. The assessment of income tax returns through electronic communication between tax officials and taxpayers that will impart greater efficiency, transparency, and accountability in the assessment process was launched by Revenue Secretary Ajay Bhushan Pandey.

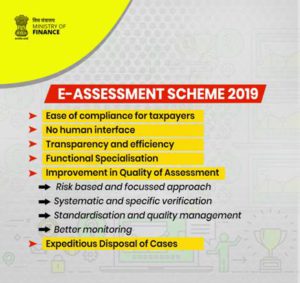

The new initiative of faceless assessment is expected to increase the ease of compliance for

taxpayers. This is another initiative by the Central Board of Direct Taxes (CBDT) in the field of ease of compliance for our taxpayers. It will impart greater efficiency, transparency, and

accountability in the assessment process and optimizes the utilization of resources through

economies of scale.

CBDT Chairman P.C. Mody and Members P.K. Das, Shri Akhilesh Ranjan and

Prabhash Shankar was also present on the occasion.

While inaugurating the NeAC, Pandey said, “It is the matter of great pride and achievement

for the Income Tax Department to bring NeAC to life in a small span of time.” Retracing the

origins of NeAC in 2017, Shri Pandey lauded the IT Department for striving to achieve

transparency with speed.

“With the launch of NeAC, the Income Tax Department will usher in a paradigm shift in its

working by introducing faceless e-assessment to impart greater efficiency, transparency and accountability in the assessment process,” Shri Pandey added.

In the first phase, the Income Tax Department has selected 58,322 cases for scrutiny under the faceless e-Assessment Scheme 2019 and the e-notices have been served before 30th of September 2019 for the cases of Assessment Year 2018-19.

Under the new system of faceless e-Assessment, taxpayers will receive notices on their

registered emails as well as on registered accounts on the web portal www.incometaxindiaefiling.gov.in with real-time alert by way of SMS on their

registered mobile number, specifying the issues for which their cases have been selected for scrutiny. The replies to the notices can be prepared at ease by the taxpayers at their own residence or office and be sent by email to the National e-Assessment Centre by uploading the same on the designated web portal.

NeAC will be an independent office to look after the work of the e-Assessment scheme which is recently notified for faceless e-assessment for income taxpayers. The NeAC in Delhi to be headed by Principal Chief Commissioner of Income Tax (Pr.CCIT).

The setting up of NeAC of the Income Tax Department is a momentous step towards the

larger objectives of better taxpayer service, reduction of taxpayer grievances in line with

Prime Minister’s vision of ‘Digital India’ and promotion of Ease of Doing Business.

There would be 8 Regional e-Assessment centers (ReAC) located in Delhi, Mumbai,

Chennai, Kolkata Ahmedabad, Pune, Bengaluru and Hyderabad comprised of assessment

unit, Review unit, Technical unit and Verification units.