New Delhi: The personal Income Tax slabs have been kept unchanged by the central government in the Budget for the financial year 2022-23, causing disappointment to the salaried class.

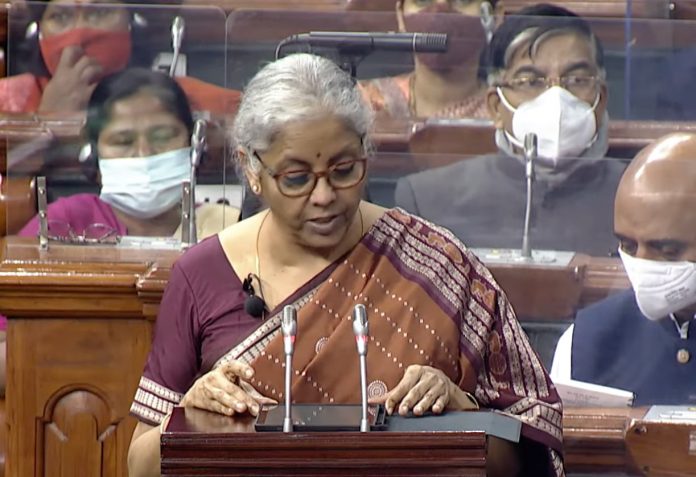

The Budget, presented by Finance Minister Nirmala Sitharaman in Parliament today, however, lays major thrust on Infrastructure creation through PPP mode reflected in ‘Gati Shakti’ implementation.

She also announced that digital currency would be unveiled during the year 2022 by the RBI as part of push to digitalisation of the economy.

The Finance Minister also proposed certain measures for encouragement of the Start-Ups and announced proposals for push to self-reliance in the defence and security sectors.

In an attempt to assuage the sentiments of the foreign investors, Sitharaman said a special Tribunal each would be set up in the Gift Cities across the country for resolution of disputes that may arise.

Prime Minister Narendra Modi said it was a “people-friendly and progressive Budget” and would help in creating employment, especially the ‘green jobs’.

The Budget, presented against the deep stress put on the economy by Covid and related restrictions, provides for raising the capex by 35% year-on-year to Rs 7.50 lakh crore to boost demand and create jobs.

While keeping the Income Tax slabs for individual taxpayers unchanged, Sitharaman said the government proposes to permit taxpayers to file an updated return on payment of additional tax within 2 years from the end of the relevant assessment year.

This would give taxpayers an opportunity to correct any omissions or mistakes in correctly estimating their income for tax payment, she said.

The Finance Minister pointed out that currently, if the Income Tax Department finds out that some income has been missed out by the assessee, it goes through a lengthy process of adjudication.

The new proposal would repose trust in the taxpayer, she said, adding, “It is an affirmative step in the direction of voluntary tax compliance.”

The Government also proposes to increase the tax deduction limit to 14 per cent from 10 per cent on employer’s contribution to the NPS account of State Government employees.

This is to enhance the social security benefits of the State government employees and bring them at par with the central government employees, Sitharaman said.

Stating that the magnitude and frequency of transactions in virtual digital assets have increased phenomenally, the Finance Minister announced that “any income from transfer of any virtual digital asset shall be taxed at the rate of 30 per cent”.

She said that the scheme would not allow any deduction in respect of any expenditure or allowance while computing such income except cost of acquisition.

Further, she said, loss from transfer of virtual digital asset cannot be set off against any other income.

The minister added that in order to capture the transaction details, the Government would also make a provision to provide for TDS on payment made in relation to transfer of virtual digital asset at the rate of 1 per cent of such consideration above a monetary threshold.

Gift of virtual digital asset is also proposed to be taxed in the hands of the recipient, she said.

Sitharaman, in line with her previous Budget, focussed again on supply side and long-term measures.

Even as experts have been pushing for raising consumption demand which has been badly hit by the Covid pandemic, the Finance Minister said that virtuous cycle of investment requires public investment to crowd-in private investment.

“Considering the imperative, the outlay for capital expenditure in the Union Budget is once again being stepped up sharply by 35.4% Rs 5.54 lakh crore in the current year to Rs 7.50 lakh crore in 2022-23,” she said.

The capex has now been increased to more than 2.2 times than the expenditure of 2019-20, she said, adding, “This outlay in 2022-23 will be 2.9 per cent of GDP.”

The Budget provided some relief to co-operative societies by reducing tax and surcharge for them. The Alternate Minimum Tax has been proposed to be reduced to 15% for co-operative societies.

“I also propose to reduce the surcharge on co-operative societies from present 12% to 7% for those having total income of more than Rs 1 crore and up to Rs 10 crores. This would help in enhancing the income of cooperative societies and its members who are mostly from rural and farming communities,” Sitharaman said.

The Budget proposed to extend concessional tax rate for new manufacturing set-ups at the rate of 15% by one year. The move is expected to drive private investment in the economy.