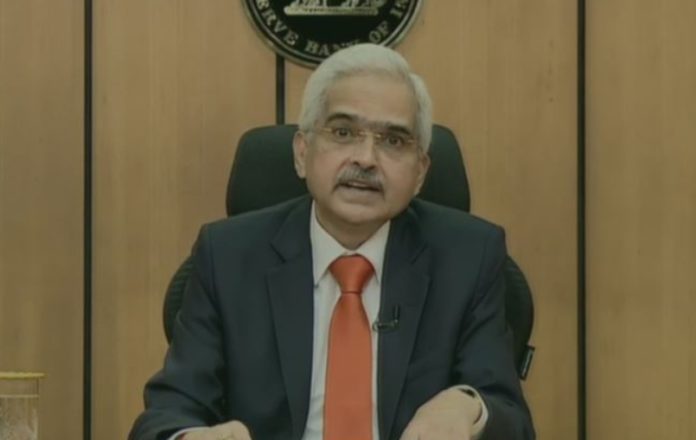

New Delhi (NVI): Amidst the huge coronavirus surge, RBI Governor Shaktikanta Das today expressed worries over the recovery of the Indian economy as he announced various measures, including Rs 50,000 crore priority lending by banks for healthcare sector covering hospitals, oxygen suppliers, vaccine importers and Covid drug manufacturers.

Noting that the RBI continues to monitor the situation arising from the resurgence of COVID-19, Das said the situation “reversed from being on foothills of strong economic recovery to facing a fresh crisis”.

He exuded full confidence in India’s resilience against the deadly coronavirus pandemic while announcing measures aimed to be enablers for the industry, banks and the general public.

“We have to marshal our resources for fighting the virus with vigour,” the RBI Governor said.

With focus on easing access to emergency healthcare services, the RBI Governor announced priority lending by banks to the tune of Rs 50,000 crore by March 31 next year.

The intended beneficiaries include a range of entities, including vaccine manufactures, importers/suppliers of vaccines and priority medical devices, hospitals/dispensaries, pathology labs, manufactures and suppliers of oxygen and ventilators, importers of vaccines and COVID related drugs and logistics firms and also patients for treatment.

He also announced 2nd window to individual, small borrowers having up to Rs 25 crore loans for restructuring loans if not availed earlier.

Rationalisation of KYC compliance norms enabling video-based KYC for certain categories was also announced, along with ease in rules for availing overdraft facility for state governments up to September 30, 2021.

Talking about the agriculture sector, Das said there is a forecast of normal monsoon, which would help contain food price inflation as the production is expected to meet the demand in coming times.

Among other announcements, the RBI Governor said there would be special long term repo operations for small finance banks to provide further support to micro, small & other unorganized sector entities and 3 year repo operations of Rs. 10,000 crore at repo rate, for fresh lending up to Rs 10 lakh per borrower facility up to October 31 this year.

In view of fresh challenges, Small Finance Banks are now permitted to regard fresh on-lending to MFIs with asset size up to Rs 500 crore, as priority sector lending, facility available up to 31 March, 2022, he said.

Given the positive response from the market, it has been decided that the second purchase of govt securities for an aggregate amount of Rs 35,000 crores under G-SAP 1.0 will be conducted on 20th May, said the RBI chief.