New Delhi : India’s economy is expected to grow at 9.5 percent in the current financial year, the Reserve Bank of India (RBI) said today as it kept Repo Rate unchanged at 4 percent and announced some additional measures to pump liquidity into the system in view of the critical state of the country’s economy.

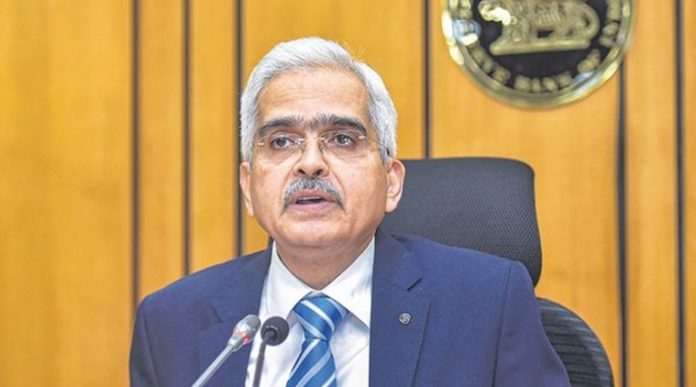

Announcing the bi-monthly Monetary Policy, RBI Governor Shaktikanta Das said unlike the first wave, impact on economic activity is expected to be relatively contained in the second wave, with restrictions on mobility being regionalised and nuanced.

While urban demand slowed in April and May 2021, vaccination process is expected to gather steam in coming months and should help to normalise economic activity, he said.

The rebound in global trade is expected to support India’s export sector, Das said, adding that rural demand is expected to remain strong, due to forecast of a normal monsoon.

Considering these factors, the RBI Governor said the Real GDP growth is projected to grow at 9.5% in 2021-22.

The Consumer Price Index inflation is projected at 5.1% in 2021-22, he said.

The RBI Governor said that growth impulses are still alive and the RBI’s measures announced today are expected to reclaim the growth trajectory.

“India’s position as Vaccine capital of the world with leadership in production of pharma products can change the COVID-19 narrative,” he said.

Das announced that the Policy Repo Rate will remain unchanged at 4% and that the Marginal Standing Facility and Bank Rate will remain at 4.25%.

The Reverse Repo Rate too will remain unchanged at 3.35%.

He informed that Monetary Policy Committee was of the view that policy support from all sides is required to gain growth momentum and to nurture recovery after it takes root.

“Hence policy rate has been left unchanged and accommodative stance has been decided to be continued as long as necessary to revive and sustain growth, while ensuring inflation remains within target” Das said.

The RBI Governor also announced a set of additional measures with the objective of reviving the economy and to mitigate the adverse impact of the second wave of the COVID-19 pandemic.

Accordingly, a separate liquidity window of Rs. 15,000 crore is being opened till March 31, 2022 with tenures up to three years, at the repo rate.

Under this scheme, Banks can give fresh lending support to hotels, restaurants, travel agents, tour operators, aviation ancillary services and other services including private bus operators, rent-a-car service providers, event organizers, spa clinics, beauty parlours and saloons, he said.

A special Liquidity Facility of Rs. 16,000 crore will be available to SIDBI, for on-lending / refinancing through novel models and structures at Repo Rate, for a period of up to one year. This is to further support credit requirements of MSMEs, including those in credit-deficient and aspirational districts.

The other measures include expansion of coverage of borrowers under Stress Resolution Framework 2.0, by enhancing maximum aggregate exposure threshold from Rs. 25 crore to Rs. 50 crore for MSMEs, non-MSME small businesses and loans to individuals for business purposes.

Permission will also be given to Authorized Dealer banks to place margins on behalf of FPI clients for transactions in Govt. securities within banks’ credit risk management framework. This will ease operational constraints faced by Foreign Portfolio Investments and promote ease of doing business.