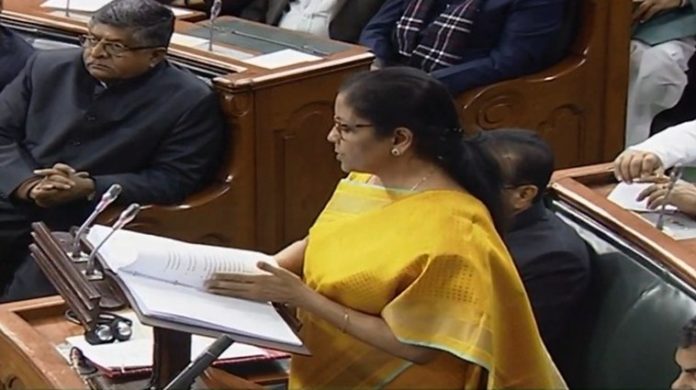

New Delhi (NVI): Industry leaders and experts gave mixed reactions to the Union Budget 2020 that was presented by Union Minister Nirmala Sitharaman in Parliament today.

Sarbendra Sarkar, Founder & Managing Director, Cygnett Hotels and Resorts

“The government’s push for infrastructure development by building more airports and as also the announcement of new Tejas trains will boost tourism outside the main centers. This, in turn, will have a positive impact on the hotel sector. We are building hotels in many new locations and with this kind of infrastructure development we will surely be a gainer.”

Ankit Agarwal, MD, Alankit Ltd

“An encouraging budget, it has reduced the personal income. Tax across levels and added new 15 per cent and 25 per cent slabs, at the same reducing exemptions so one would have to see the benefit that actually comes to the taxpayer. The focus clearly is on increasing compliance and reducing litigation; further a reduced corporate tax to 15 per cent and tax on ESOP deferred by 5 years are good moves made by the government. Once again, the FM touched upon simplified GST filing and simplified refund prices; which is the need of the hour. SMS filing are good moves”.

Ola Mobility Institute

“The budget’s focus on the development of transportation infrastructure, specifically on urban transportation through allocation of funds for metro-rail projects will help achieve Ease of Living through Ease of Moving. The transportation infrastructure development should also focus on accessibility to all including senior citizens and persons with disabilities. Sub-urban rail will boost multi-modal connectivity and open up new economic opportunities for areas in and around cities like Bengaluru.”

Rohan Parikh (Director – The Green Acres Academy)

“As a country gearing up to have the largest ‘working population’ in the age group of 15 to 65 years of age by 2030, the Budget 2020 has adequately focused on building a robust structure to drive higher education and skill development. From creating an efficient workforce of engineers, doctors, bio-medics and IT professionals to nurturing skill-based qualities for entrepreneurs, sales and marketing professionals or commercial fine arts etc., the budget has taken into consideration the inclination of the youth and aligned it to the economic growth targets, thereby strengthening the role of education in building the $5 Trillion economy!”

Gene Fang, Associate Managing Director, Sovereign Risk, Moody’s Investors Service

“India’s 2020/21 budget highlights the challenges to fiscal consolidation from slower real and nominal growth, which may continue for longer than the government forecasts. This risk is reflected in Moody’s negative outlook on India’s rating.

“India’s general government debt is already significantly higher than the average for Baa-rated sovereigns – a product of persistent fiscal deficits. While India’s new budget calls for a modest narrowing of the deficit to 3.5% in the fiscal year 2020/21 from 3.8% in the fiscal year 2019/20, sustained weaker growth and tax cuts would make gross revenue targets difficult to achieve. The government also has limited room to reduce expenditures without further weakening growth.

While the government remains committed to medium-term fiscal consolidation, any material strengthening in India’s public finances will likely be limited in the near term, and the debt burden will remain sensitive to changes in nominal GDP growth.”

Anil Talreja, Partner, Deloitte India

“Budget 2020 clearly demonstrates the commitment to double farmers income by 2022 by announcing numerous reforms for the agricultural sector such as detailed 16 points action plan, Integrated farming systems in rain-fed areas, Kisan Rail for cold storage facilities for perishable produce by railways, promoting generating income to barren land farmers through agricultural solar plans with overall expenditure budge of INR 2.83 lakhs.

Further, announcements such as employment generation opportunity by way of the national infrastructure pipeline, Wellness, water and sanitization measures, setting up of hospitals in Tier II and Tier III cities, Promoting tourism sector, FDI in education sector should also refuel the growth engine of consumer sector as a whole.”

Mahendra Singhi, President, Cement Manufacturers Association & Managing Director and CEO, Dalmia Cement (Bharat) Limited

“The Cement Industry welcomes the Government’s intent to push infrastructure development. The emphasis on highways and roads development is well placed. This captures the priorities of economic development and an aspirational India. We would hope that rural demand gets revived and it assists in job creation. We are actively engaged in dialogue with the Ministry of Commerce on the National Logistics Policy and would expect some of our considerations for upgradation and modernisation of rail infrastructure are particularly carried through. Thirdly, the Cement Industry has also been an active partner to the Government in the Swachh Bharat Mission. Reference and priority in this context being accorded to source segregation and processing should add to creating a more facilitating environment for the role expected of the Cement Industry in waste management given that Polluter to Pay principle has been outlined in the National Resource Efficiency Policy. Overall good to see Budget 2020-21, which reiterates the priorities for economic development. We would look forward to these taking shape. The reaffirmation of commitment towards clean air, Climate Change mitigation efforts are most welcome. More policy interventions to revive real estate and housing would be welcome. Infrastructure development, new 100 airports and emphasis on road would go a long way to revive cement demand.”

Neeraj Akhoury, Vice President, Cement Manufacturers Association & CEO and Managing Director, ACC Limited

“The special emphasis on infrastructure development that the Government has undertaken over the past few months has been strengthened in the Budget announcement today by the Hon’ble FM. The focus on project preparation facilities for infra projects and the national logistics policy that will be released soon should help boost infrastructure and have a positive impact on the economy. Budget 2020-21 aims at making growth more inclusive while retaining focus on the immediate priorities. Priorities given to household, roads, railways, economic corridors, solar power, accelerated development of highways should help boost development and wealth creation. The Cement industry is committed towards playing a strong role in the Government’s aspirational agenda for transformative economic growth.”